Information Acquisition Costs and Price Informativeness: Global Evidence

Abstract

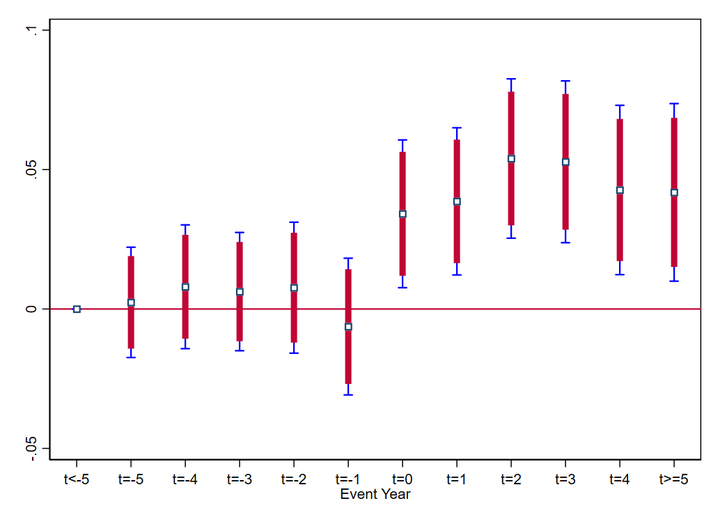

We study how global changes in information acquisition costs affect price informativeness. To provide evidence on this issue, we examine worldwide adoptions of centralized electronic disclosure systems. Despite broadening the dissemination of corporate disclosures, we find a significant reduction in information acquisition before earnings announcements post-adoption. These effects are most pronounced in countries with the most substantial reductions in information acquisition costs and where we find more significant decreases in informed trade. Overall, we highlight a critical tension between acquiring disclosure information and incorporating it into asset prices.

Type

Publication

Working Paper