Where's the Greenium?

Abstract

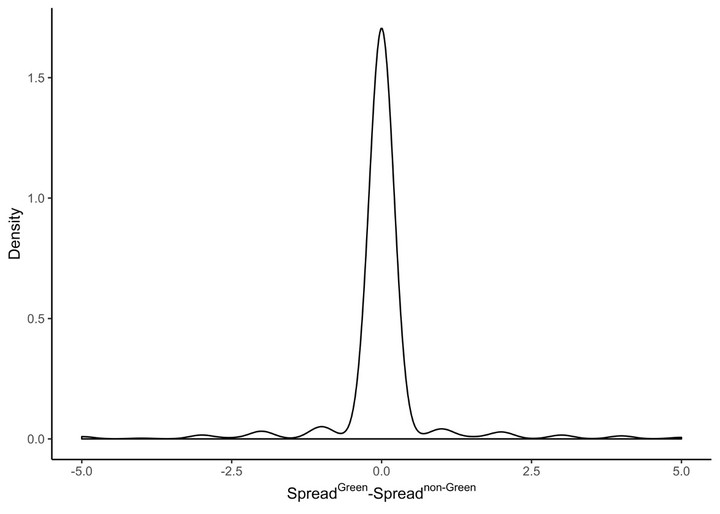

In this study, we investigate whether investors are willing to trade off wealth for societal benefits. We take advantage of unique institutional features of the municipal securities market to provide insight into this question. Since 2013, states and other governmental entities have issued over $23 billion of green bonds to fund eco-friendly projects. Comparing green securities to nearly identical securities issued for non-green purposes by the same issuers on the same day, we observe economically identical pricing for green and non-green issues. In contrast to a number of recent theoretical and experimental studies, we find that in real market settings investors appear entirely unwilling to forgo wealth to invest in environmentally sustainable projects. When risk and payoffs are held constant and are known to investors ex-ante, investors view green and non-green securities by the same issuer as almost exact substitutes. Thus, the greenium is essentially zero.