Earnings News and Over-the-Counter Markets

Abstract

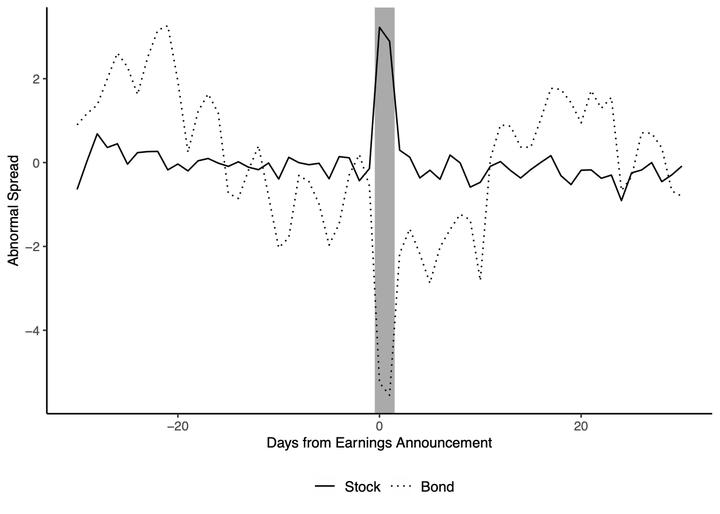

We document significant increases in bond market liquidity around earnings announcements. These increases are attributed to decreased search and bargaining costs, which arise from the over-the-counter (OTC) nature of bond markets and outweigh increases in information asymmetry during these periods. Our evidence traces reductions in search and bargaining costs to two sources around earnings announcements: (i) improved access to dealers and (ii) increased participation from institutional investors, who can more easily transact with multiple dealers. Overall, our findings highlight a novel channel through which firm-specific information affects asset prices.

Type

Publication

Journal of Accounting Research, 62 (2): 701–735 (May 2024)