Retail Bond Investors and Credit Ratings

Abstract

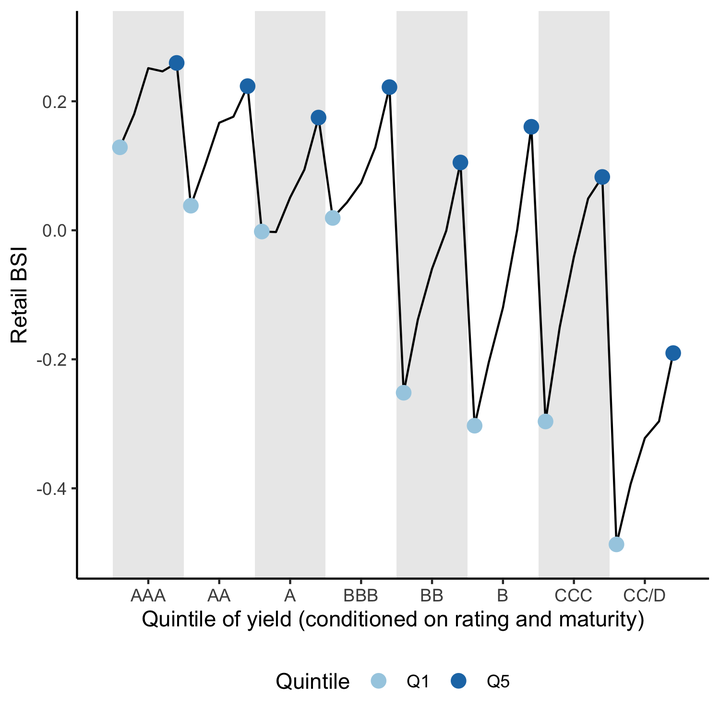

Using comprehensive data on U.S. corporate bond trades since 2002, we find evidence that retail bond investors overrely on untimely credit ratings to their financial detriment. Specifically, they appear to select bonds by first screening on a credit rating and then sorting by yield, buying the highest-yielding bonds within each rating level. Because yields lead credit rating changes, selecting on yield-within-rating means that retail investors systematically trade in the opposite direction of changing fundamentals, buy in advance of credit downgrades and defaults, and materially underperform a diversified portfolio. Our study provides new evidence of ill-informed retail trading in a market that is thought to be relatively sophisticated, corroborates regulators’ concerns about investor overreliance on credit ratings, and contributes to the academic literature on the roles and consequences of credit ratings in debt markets.